Best Credit Card Processing Solutions Tailored for Every Industry

By admin November 16, 2024

In today’s digital age, electronic payments have become the norm, replacing traditional paper checks and cash transactions. One such method is the Automated Clearing House (ACH) transfer, which allows individuals, businesses, and government entities to send and receive funds electronically. ACH transfers offer a convenient and secure way to handle financial transactions, making them an essential part of the modern banking system.

An Automated Clearing House (ACH) transfer is a type of electronic funds transfer that enables the movement of money between bank accounts within the United States. It is a reliable and efficient method for conducting various types of payments, including direct deposits, bill payments, and business-to-business transactions. Understanding how ACH transfers work and their key features is crucial for anyone who wants to make or receive payments electronically.

How Does an Automated Clearing House (ACH) Transfer Work? Exploring the Process Step by Step

To comprehend the intricacies of ACH transfers, it is essential to delve into the step-by-step process involved. The process begins with the sender initiating the transfer, either through their bank’s online platform or a third-party payment service provider. The sender provides the necessary information, including the recipient’s bank account number, routing number, and the amount to be transferred.

Once the transfer is initiated, the sender’s bank submits the transaction to the ACH network, which acts as a central clearinghouse for all Automated Clearing House (ACH) transfers. The ACH network processes the transaction and verifies the sender’s account balance to ensure sufficient funds are available. If the funds are available, the ACH network sends the transfer request to the recipient’s bank.

Upon receiving the transfer request, the recipient’s bank credits the funds to the recipient’s account. The entire process typically takes one to two business days, although same-day Automated Clearing House (ACH) transfers are becoming increasingly common. It is important to note that ACH transfers are typically batched and processed in bulk, which contributes to their efficiency and cost-effectiveness.

ACH Transfer vs. Wire Transfer: Key Differences and Similarities

While ACH transfers and wire transfers both involve the electronic movement of funds, there are significant differences between the two methods. A wire transfer is a real-time transaction that allows for immediate transfer of funds between banks, while an Automated Clearing House (ACH) transfer takes longer to process. Wire transfers are often used for urgent or high-value transactions, such as international transfers or large business payments.

On the other hand, Automated Clearing House (ACH) transfers are more suitable for routine payments, such as payroll deposits or recurring bill payments. They are generally less expensive than wire transfers, making them a preferred choice for individuals and businesses looking to save on transaction fees. Additionally, ACH transfers are subject to specific rules and regulations set by the National Automated Clearing House Association (NACHA), while wire transfers are governed by the Federal Reserve.

Types of ACH Transfers: Consumer, Business, and Government Payments

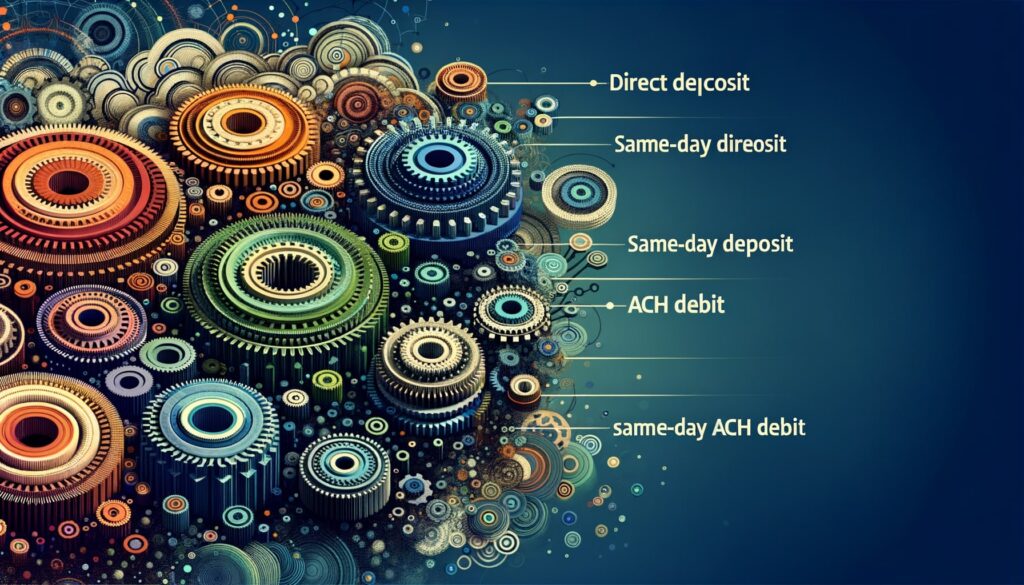

ACH transfers cater to various types of payments, serving the needs of consumers, businesses, and government entities. Consumer Automated Clearing House (ACH) transfers include direct deposits of salaries, pensions, and government benefits, as well as online bill payments and person-to-person transfers. These transfers provide individuals with a convenient and secure way to manage their finances and make payments electronically.

Business Automated Clearing House (ACH) transfers, on the other hand, facilitate a wide range of transactions, including payroll processing, vendor payments, and business-to-business transfers. By leveraging ACH transfers, businesses can streamline their payment processes, reduce administrative costs, and improve cash flow management. Automated Clearing House (ACH) transfers also enable businesses to offer direct deposit options to their employees, enhancing employee satisfaction and reducing the reliance on paper checks.

Government Automated Clearing House (ACH) transfers play a crucial role in facilitating various government payments, such as tax refunds, social security benefits, and vendor payments. These transfers ensure timely and efficient delivery of funds, benefiting both the government and the recipients. By utilizing ACH transfers, government agencies can reduce administrative costs, minimize errors, and enhance the overall efficiency of their payment systems.

A Closer Look at ACH Network: Understanding the Infrastructure

The ACH network serves as the backbone of Automated Clearing House (ACH) transfers, providing the infrastructure necessary for the secure and efficient movement of funds. The network is operated by the National Automated Clearing House Association (NACHA), a nonprofit organization that establishes and enforces the rules and standards governing ACH transactions.

The ACH network consists of financial institutions, including banks and credit unions, that participate in the transfer process. These institutions act as originators or receivers of Automated Clearing House (ACH) transfers, depending on whether they are sending or receiving funds. The network also includes the Federal Reserve, which acts as a clearinghouse for ACH transactions and ensures the smooth settlement of funds between participating banks.

To facilitate the secure transmission of data, the ACH network utilizes encryption and authentication protocols. This ensures that sensitive financial information remains protected throughout the transfer process. Additionally, the ACH network operates on a set of standardized formats and codes, allowing for seamless interoperability between different financial institutions.

Benefits and Advantages of ACH Transfers: Why Choose this Payment Method?

ACH transfers offer numerous benefits and advantages over traditional payment methods, making them an attractive option for individuals and businesses alike. One of the key advantages is the convenience and efficiency they provide. Automated Clearing House (ACH) transfers eliminate the need for paper checks, reducing the time and effort required to process payments. They also enable individuals and businesses to automate recurring payments, ensuring timely and accurate transactions.

Another significant advantage of ACH transfers is their cost-effectiveness. Compared to other payment methods, such as wire transfers or credit card payments, Automated Clearing House (ACH) transfers are typically more affordable. They often involve lower transaction fees, making them an economical choice for businesses that process a large volume of payments.

ACH transfers also offer enhanced security compared to traditional payment methods. By eliminating the need for physical checks or cash, Automated Clearing House (ACH) transfers reduce the risk of theft or loss during the payment process. Additionally, the encryption and authentication protocols used by the ACH network ensure the confidentiality and integrity of financial data, protecting both senders and recipients from fraud or unauthorized access.

Automated Clearing House (ACH) Transfer Fees: Understanding the Costs Involved

While Automated Clearing House (ACH) transfers are generally more cost-effective than other payment methods, it is important to understand the fees associated with these transactions. The fees for ACH transfers can vary depending on several factors, including the financial institution, the type of transfer, and the volume of transactions.

Most banks charge a nominal fee for outgoing Automated Clearing House (ACH) transfers, typically ranging from $0.10 to $1.00 per transaction. Some banks may also impose additional fees for expedited or same-day ACH transfers. It is advisable to check with your bank or payment service provider to understand their specific fee structure and any applicable charges.

For businesses that process a high volume of Automated Clearing House (ACH) transfers, banks may offer discounted fees or subscription-based pricing models. These arrangements can help businesses save on transaction costs and improve their overall payment processing efficiency. It is recommended to explore different banking options and compare fee structures to find the most cost-effective solution for your specific needs.

ACH Transfer Limits: Exploring the Maximum and Minimum Transaction Amounts

ACH transfers are subject to certain limits imposed by financial institutions and regulatory authorities. These limits ensure the security and integrity of the payment system while accommodating the needs of individuals and businesses. The specific limits may vary depending on the bank and the type of transfer.

For consumer Automated Clearing House (ACH) transfers, such as direct deposits or bill payments, most banks do not impose any maximum transaction limits. However, there may be a minimum transaction amount, typically ranging from $1 to $10. This minimum amount helps banks cover the administrative costs associated with processing ACH transfers.

Business Automated Clearing House (ACH) transfers, on the other hand, may be subject to both maximum and minimum transaction limits. The maximum limit is usually set by the bank and can vary significantly depending on the institution and the business’s relationship with the bank. It is advisable to consult with your bank to understand the specific limits applicable to your business.

Automated Clearing House (ACH) Transfer Security: Safeguarding Your Financial Information

Security is a paramount concern when it comes to electronic payments, and ACH transfers are no exception. The ACH network employs several security measures to protect the confidentiality and integrity of financial information during the transfer process.

One of the key security features of Automated Clearing House (ACH) transfers is encryption. Encryption ensures that the data transmitted between financial institutions remains secure and cannot be intercepted or tampered with by unauthorized individuals. The ACH network utilizes industry-standard encryption protocols to safeguard sensitive financial data.

In addition to encryption, the ACH network employs authentication mechanisms to verify the identity of participants in the transfer process. This helps prevent unauthorized access to the system and ensures that only legitimate transactions are processed. Financial institutions also implement robust security measures, such as firewalls and intrusion detection systems, to protect their networks and customer data.

It is important for individuals and businesses to take their own security precautions when initiating ACH transfers. This includes using secure and trusted online banking platforms, regularly updating passwords, and being cautious of phishing attempts or suspicious emails. By following best practices and staying vigilant, individuals and businesses can further enhance the security of their Automated Clearing House (ACH) transfers.

Frequently Asked Questions (FAQs)

Q1. What is the difference between Automated Clearing House (ACH) transfers and wire transfers?

Automated Clearing House (ACH) transfers and wire transfers differ in terms of speed, cost, and use cases. ACH transfers are typically slower and more cost-effective, making them suitable for routine payments. Wire transfers, on the other hand, are faster and more expensive, often used for urgent or high-value transactions.

Q2. Can I reverse an ACH transfer?

In most cases, Automated Clearing House (ACH) transfers cannot be reversed once they have been initiated. However, if there is an error or unauthorized transaction, you should contact your bank immediately to report the issue and explore possible solutions.

Q3. Are ACH transfers secure?

Yes, Automated Clearing House (ACH) transfers are secure. The ACH network employs encryption and authentication protocols to protect the confidentiality and integrity of financial data. It is important for individuals and businesses to follow security best practices and use trusted banking platforms to further enhance the security of their ACH transfers.

Q4. Can I set up recurring payments with ACH transfers?

Yes, ACH transfers are commonly used for recurring payments, such as monthly bills or payroll deposits. By setting up automatic payments, individuals and businesses can ensure timely and accurate transactions without the need for manual intervention.

Q5. Are there any transaction limits for ACH transfers?

While there may be minimum transaction amounts for consumer ACH transfers, most banks do not impose maximum transaction limits. However, business Automated Clearing House (ACH) transfers may be subject to both maximum and minimum transaction limits, which can vary depending on the bank and the business’s relationship with the institution.

Conclusion

ACH transfers have revolutionized the way we handle financial transactions, offering a convenient, secure, and cost-effective method for sending and receiving funds electronically. By understanding the basics of Automated Clearing House (ACH) transfers, including how they work, their key features, and the benefits they offer, individuals and businesses can make informed decisions when it comes to managing their finances.

Whether it’s a consumer making a direct deposit, a business processing payroll, or a government agency disbursing benefits, ACH transfers play a crucial role in facilitating various types of payments. The ACH network, with its robust infrastructure and security measures, ensures the smooth and efficient movement of funds between financial institutions.

While Automated Clearing House (ACH) transfers offer numerous advantages, it is important to be aware of the associated fees, transaction limits, and security considerations. By staying informed and taking necessary precautions, individuals and businesses can leverage the benefits of ACH transfers while safeguarding their financial information.

In conclusion, Automated Clearing House (ACH) transfers have become an integral part of the modern banking system, providing individuals, businesses, and government entities with a reliable and efficient method for conducting electronic payments. As technology continues to advance, ACH transfers are likely to evolve further, offering even greater convenience, security, and cost-effectiveness in the years to come.